2024 : a soft economic landing

Macro Point

In 2023, GDP growth exceeded expectations, while core inflation fell from 6% in 2022 to 3% in the US, reflecting the effects of aggressive monetary policies and post-COVID normalization. Curiously, the year saw no major shocks affecting supply, demand or world trade, with inflation on the decline thanks to a combination of monetary policies and adjusted economic behavior. Consumers moderated their purchases, companies adjusted their inventories, and governments cut back on excessive spending. The year 2024 will be marked by phases of crisis and doubt across many spectrums. Numerous deadlines will mark market stresses and instabilities that we must take advantage of.

US inflation

Sources : Bloomberg, Groupe Richelieu

Our forecast for 2024 assumes a soft economic landing despite elections likely to generate surprises due to rising populism and polarization. Central banks, anticipating these uncertainties, will remain cautious, delaying any rate cuts. We envisage a US recession in mid-2024, tempered by stable economic factors, including tight labor markets and excess household savings supporting growth.

While growth dynamics will remain heterogeneous between regions, inflation dynamics will be more homogeneous. Most countries will experience gradual disinflation as the effects of supply shocks dissipate, combined with tighter financial conditions.

However, high wage pressures, challenging real estate markets and rising financing costs for banks and businesses are notable risks. These factors, combined with hesitant monetary policy, could restrict access to credit and increase financing costs.

While the market expects disinflation in the months ahead, inflationary risks remain, including the possibility of a new shock.

Fed rate expectations

Sources : Bloomberg, Richelieu Group

Economics aside, every geographical zone has its own geopolitical hot spot. In Europe, the war in Ukraine is getting bogged down, and an escalation of the conflict could be on the horizon. In Asia, Taiwan’s presidential election on January 13 could rekindle tensions in the China Sea. In the Middle East, Israel’s offensive in the Gaza Strip following the terrorist attacks by Hamas on October 7 leaves no diplomatic way out. In the United States, the primaries begin on January 15, and on November 5 the American elections will take place, exacerbating the disparities between Republicans and Democrats as never before.

While the market expects disinflation in the months ahead, inflationary risks remain, including the possibility of a new shock. Generally speaking, the easiest job is being done: bringing inflation down from 8% to 9% to 3% to 4%, as base effects are in action. The disinflation of goods and energy is over, and must now spread to services and wages. The transition from 3% to 4% to 1.5% to 2% will certainly be trickier. It’s also the fear of entering into a stop-and-go spiral of the 70s, which was a failure before Paul Volcker arrived. So we’ll have to wait a while before we can be sure that inflation is under control, much longer than the market thinks….

The lags in the cumulative tightening of monetary policy are having a tangible impact on economic activity and inflation, even if they have improved recently.

Financial conditions index

Sources : Goldman Sachs, Bloomberg

It would be wise not to underestimate the time it will take to achieve sustainable inflation control.

The scenario of imminent, large-scale monetary easing, which is still in the majority on the financial markets, seems to us to be over-optimistic in view of the persistence of upward inflationary risks (all the more so with tensions still prevalent in the Red Sea) and the continuation of second-round effects caused by wage increases.

During December, we lowered our outlook on US sovereign yields, on which we had been positive given the recent movement. We expect the Fed’s rate cuts to steepen the curve. Other central banks should take advantage of this to maintain a status quo policy and push their currencies up, which should be positive for the euro. We remain in the same vein as last month in terms of macro-economic factors. We are convinced that, in the short term, the Fed will set the pace. The downward potential of 10-year sovereign yields will remain constrained by the absence of a recession and the Fed’s cautious stance. As the Fed’s balance sheet continues to shrink, more US debt will have to be absorbed by investors.

10-year rate

Sources : Bloomberg , Groupe Richelieu

While we were expecting US and European sovereign yields to fall, the movement that has taken place since mid-October 2023 has been too rapid in our view, and central banks will have to correct the optimism on bond markets.

We have taken stock of the latest communications from the US central bank since the last FOMC meeting on November. Even if the desire to fight inflation remains firmly anchored, we are convinced that the coming months will give greater latitude to the rhetoric.

The euro’s appreciation against the dollar is set to continue as European growth prospects improve in line with the rebound in business indicators. In addition, the ECB will cut its key rates much more gradually than consensus expects.

Euro versus other currencies

Sources : Bloomberg, Richelieu Group

We are therefore adopting a slightly more cautious stance than the consensus regarding the timing of the first rate cuts (scheduled for June by the ECB and the Fed), and believe that the return to an equilibrium rate will take several quarters, in a context where inflation is structurally evolving. However, this caution does not call into question the disinflation trajectory we continue to anticipate, which should gradually pave the way for improved growth prospects in the eurozone.

Three “drivers” should gradually take hold in the first half of 2024: the rise in real wages and hence consumption, the gradual improvement in financial and banking conditions, and the upturn in the industrial cycle due to the end of destocking on the one hand, and the spread of stimulus plans on the other. A situation which should be more profitable for cyclical stocks.

As far as equity markets are concerned, barring an exogenous shock, we continue to believe that the situation remains favorable for companies, which should contain the fall in their margins.

In relative terms, even if Japanese demand is recovering, the lack of visibility regarding the BoJ’s monetary policy leads us to be more cautious. The “inflation-wage” spiral is gradually taking hold, which should enable the BoJ to definitively rule out the risk of structural disinflation. This last point is a key factor in encouraging it to exit its ultra-accommodating monetary policy this year.

| Allocation | – – | – | 0 | + | + + |

|---|---|---|---|---|---|

| Equities | |||||

| Bonds | |||||

| Cash |

| Equites | |

|---|---|

| Europe | |

| US | |

| Japan | |

| Emerging |

| Currencies | |

|---|---|

| USD |

| Commodities | |

|---|---|

| Oil | |

| Gold |

| Bonds | – – | – | 0 | + | + + |

|---|---|---|---|---|---|

| US Government | |||||

| UE Government | |||||

| Inv. Grade US | |||||

| Inv. Grade Europe | |||||

| High Yield US | |||||

| High Yield Europe | |||||

| Emerg. countries |

| Preferences | ||

|---|---|---|

| Growth / Yield / Innovation | US government bonds | Europe crossover bonds |

Against this backdrop, we wanted to highlight four themes that we feel are appropriate for 2024: a geographical theme, India; a theme on European small and mid caps; a theme on a bond asset class, subordinated hybrid bonds; and a structural theme on artificial intelligence.

I. Artificial Intelligence: a revolution

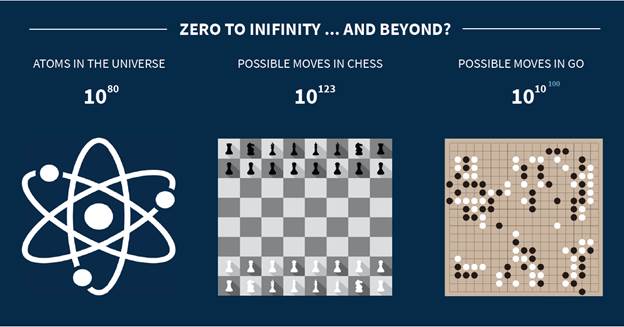

To fully grasp the scope and complexity of artificial intelligence capabilities, we need look no further than China’s traditional game of Go. Unlike chess, played with 32 pieces on an 8×8-square board, Go is played with over 360 pieces on an 18×18-square board, making it infinitely more complex. While the total number of possible moves in chess is estimated at 10^123, the number of possible moves in a typical game of Go is estimated at 10^10^100. To put these figures into perspective, the total number of atoms in the observable universe is estimated at only around 10^80.

Source : Raymond James

The game is so intricate that Go champions dedicate most of their lives to mastering it. However, an AI-powered computer accomplished this feat in just three days. DeepMind, a computer company, developed an AI program aptly named «AlphaGo.» This software «learned» to play Go by analyzing millions of past games and engaging in countless games against itself, continually enhancing its gameplay. AlphaGo eventually triumphed over Go world champions on numerous occasions. Despite its prowess, AlphaGo’s primary weakness lay in its inability to devise new moves; its knowledge was grounded in previously played games. This is where AlphaGo Zero distinguished itself. Unlike AlphaGo, which had access to millions of past games for analysis, AlphaGo Zero only had the game rules at its disposal. Its sole method of «learning» Go was by playing against itself. Additionally, unlike AlphaGo, AlphaGo Zero was powered by an artificial neural network. In a mere three days, AlphaGo Zero evolved to the point where it outperformed its predecessor, AlphaGo, over 100 consecutive times. AlphaGo Zero serves as a prime example illustrating the scale and potential of AI, offering a microcosmic glimpse into its boundless future possibilities.

Since the dawn of civilization, technology has been a fundamental driver of human development. Every era has been characterized by technological advances that not only redefine the way we live but also enhance our capacity to comprehend and reshape the world around us. From the invention of the wheel to the advent of the printing press, each innovation has opened up new avenues, expanding the horizons of what was once thought possible. At the turn of the 18th century, the world witnessed an unprecedented acceleration in technological innovation during the Industrial Revolution. Steam engines, mass production, and new modes of transport not only transformed production methods but also restructured the social and economic fabric of the time.

These innovations were not mere incremental improvements; they represented radical shifts in societal functioning. The ability to mass-produce, rapidly transport goods over long distances, and communicate efficiently across vast networks paved the way for unprecedented economic expansion. Cities burgeoned, populations migrated, and new markets emerged, creating an interconnected, technology-dependent world. In this context, technology was not just a tool; it acted as a catalyst for change, redefining the boundaries of what was achievable. Each innovation brought forth novel ways of solving age-old problems, providing better and faster solutions than ever before.

Today, we stand at the threshold of a new technological era dominated by artificial intelligence. Similar to past technological revolutions, AI has the potential to radically transform our society. It promises to redefine not only our economy but also the way we live, work, and interact with one another. AI represents the current frontier of human progress, a realm where innovation continually pushes the boundaries of what is deemed possible.

The advent of artificial intelligence signifies a new chapter in the history of technological innovation. Much like the steam engine and the computer revolutionized their respective eras, AI is poised to reshape our world with unprecedented scope and speed. This revolution transcends the enhancement of existing processes; it ushers in new paradigms of thinking, working, and solving complex problems. AI systems can analyze vast amounts of data, learn from experiences, and continuously enhance their performance without direct human guidance. This capacity for self-improvement and adaptation unveils previously unimaginable possibilities in nearly every sector of the economy.

AI is not merely a tool for enhancing efficiency; it is a catalyst for innovation. It empowers companies to discover new ways of serving their customers, optimize operations, and create novel products and services. Enterprises embracing AI can anticipate substantial improvements in competitiveness, productivity, and profitability.

AI represents a technological revolution with the potential to profoundly transform our economy and society. It offers unprecedented opportunities for companies and investors prepared to embrace this new era of innovation. Artificial intelligence, a field of computer science seeking to create systems capable of tasks traditionally requiring human intelligence, stands out for its ability to learn and adapt, fundamentally transforming our interactions with technology and one another.

AI has progressed rapidly over the last few decades, often surpassing expectations and redefining technological possibilities. With capabilities such as machine learning and natural language processing, AI can analyze complex datasets, learn new information, and perform tasks with unparalleled accuracy and efficiency.

A notable example of AI’s power is its capability to process and analyze massive amounts of data far beyond human capacity.

Source: Illustration by DALL-E

AI is not solely a tool for improving existing processes; it is also a driver of innovation.

AI raises critical questions about ethics, security, privacy, and its impact on employment. As AI continues to evolve, it is imperative to consider these implications and ensure responsible and equitable deployment.

Source : X (formerly Twitter)

Today’s artificial intelligence is built upon key technological advances that have facilitated its rapid development and integration into various fields.

Natural Language Processing (NLP), a branch of AI enabling machines to understand and interact with human language, lies at the heart of voice assistants like Siri and Alexa, machine translation systems, and chatbots. NLP utilizes complex algorithms to analyze, interpret, and respond to human language in a manner once considered exclusively human. This ability to process natural language opens new avenues for man-machine interaction, making technologies more accessible and intuitive.

Machine learning, a method by which AI systems learn and improve from experience without explicit programming, enables machines to analyze large datasets, identify patterns, and make predictions or decisions based on this data. Machine learning is particularly potent in areas like fraud detection, personalizing product recommendations, and forecasting market trends.

Artificial neural networks, inspired by the workings of the human brain, are designed to mimic human neurons’ interactions. This approach enables AI systems to recognize patterns and make decisions similarly to the human mind. Neural networks excel in complex tasks like image and voice recognition, playing a pivotal role in technologies such as facial recognition.

At the core of these advances lies data. AI relies on substantial amounts of data to learn and improve. This dependence underscores the importance of data collection, storage, and analysis in the modern world. Companies effectively leveraging their data are better positioned to reap the benefits of AI.

In the real world, AI is already transforming numerous sectors. In healthcare, AI aids in diagnosing diseases faster and more accurately. In the financial sector, it facilitates sophisticated market analysis and automated decision-making. In the automotive sector, AI is integral to the development of autonomous vehicles. In retail, AI enables a more personalized customer experience.

The integration of artificial intelligence into various economic sectors has the potential to drastically transform the global economy. AI’s impact extends beyond operational efficiency, presenting opportunities for growth, innovation, and economic development.

AI serves as a powerful driver of economic growth, enabling companies to optimize operations, reduce costs, and improve product and service quality. For instance, in manufacturing, AI can enhance productivity by optimizing production lines and minimizing downtime. In retail, AI facilitates more personalized shopping experiences, increasing customer satisfaction and loyalty.

AI holds the potential to revolutionize entire industries.

The impact of artificial intelligence on the job market is a subject of intense debate. While AI offers opportunities for automation and efficiency, it also prompts questions about job redefinition and the skills demanded by the future economy. Automation can enhance efficiency and lower costs, but it also raises concerns about potential job displacement. Concurrently, AI creates new job opportunities and expertise areas.

Adapting to the changes brought about by AI poses a significant challenge for workers, companies, and governments. Developing strategies to manage employment transitions, including training and outplacement for workers affected by automation, is crucial. Additionally, considering the social implications of these changes is essential to ensure a fair and inclusive transition.

The adoption of artificial intelligence represents a major strategic opportunity for investors and companies alike. AI is not just a technological innovation; it is a driver of economic and business transformation. Companies integrating AI into their operations can gain a substantial competitive advantage. AI improves operational efficiency, reduces costs, speeds up production, and offers greater personalization of products and services. These benefits can translate into increased market share and higher profitability. For investors, AI presents a promising investment area. Companies developing or adopting AI technologies are well positioned for growth in an increasingly technology-driven market. Investing in AI is not just a wager on a specific technology; it is also a bet on the future of the digital economy.

Artificial intelligence signifies an unprecedented technological and economic revolution. Its impact on society, the economy, and the world of work is profound and will continue to grow in the years to come.

Artificial intelligence (AI) market size worldwide in 2021 with a forecast until 2030

Source : Statista

The future of AI is replete with promises and challenges. Navigating this evolving landscape will require a commitment not only to technological innovation but also to understanding the social and ethical implications of AI for companies and investors.

As a transformative force, AI is not merely a technological tool; it is a catalyst for change, opening up new avenues to solve complex problems, stimulate economic growth, and improve the quality of life. Companies and individuals who embrace this technology while remaining aware of its implications will be best positioned to thrive in the age of artificial intelligence.

AI, a Universal Transformation Lever for All Sectors.

Looking ahead, it becomes increasingly evident that artificial intelligence is not confined to specific fields or industries. On the contrary, AI is emerging as a universal lever for transformation, capable of bringing significant benefits to all sectors and businesses, regardless of size or specialization.

AI’s impact extends well beyond traditional technological boundaries. Sectors as diverse as healthcare, finance, education, agriculture, and even the arts and humanities find themselves on the brink of an AI-led revolution. This technology offers unprecedented possibilities for optimization, innovation, and customization, catering to the specific needs of each field.

Source : Financial Times (click here)

AI is not a privilege reserved for large companies. Small and medium-sized businesses can also leverage it to improve processes, better understand customers, and position themselves more competitively in the marketplace. The increasing accessibility of AI tools and the democratization of data open up opportunities even for companies with limited resources.

In the years to come, AI will act as a catalyst for growth and innovation in all sectors. It will enable companies to discover new ways of working, create new products and services, and explore previously inaccessible markets. AI can help solve complex problems, predict trends, and optimize strategic decisions, offering a significant competitive advantage.

North America dominated the market, accounting for over 36.8% of global revenue share in 2022. This high share is attributable to favorable government initiatives encouraging AI adoption across various industries. For example, in February 2019, U.S. President Donald J. Trump launched the U.S. AI Initiative as a national strategy to promote leadership in artificial intelligence. As part of this initiative, federal agencies fostered public confidence in AI-based systems by establishing guidelines for their development and implementation in various industrial sectors.

Source : Grand View Research

The future will be marked by the ever-deeper integration of AI into all aspects of economic and social activity. Companies anticipating and adapting to this evolution will thrive in this new landscape. AI is not a passing trend; it represents a fundamental evolution in the way we live, work, and interact with the world around us.

AI is likely to benefit all sectors and businesses in the years to come.

Source : Grand View Research(click here)

The artificial intelligence revolution, while opening unprecedented horizons of opportunity, also creates a distinct dynamic of winners and losers. Winners will include those actively embracing AI, innovative companies integrating it into their processes, workers acquiring skills in AI and data analysis, and sectors rapidly adapting to new technologies. These players will benefit from increased efficiency, improved decision-making, and a competitive edge.

On the other hand, potential losers are those resisting or slow to adapt to these changes. This includes companies clinging to obsolete business models, workers whose skills become redundant due to automation, and sectors failing to integrate technological innovations. These groups risk falling behind in an economy increasingly dominated by AI, impacting employment, market share, and overall relevance.

For portfolio managers, the integration of artificial intelligence into investment strategies is an unavoidable imperative. AI is not just a technological revolution; it represents a key driver of transformation and growth across all sectors. Companies adopting and integrating AI into their operations, products, or services are often at the forefront of innovation, offering superior growth and profitability potential. Assessing a company’s maturity and commitment to AI becomes an essential criterion for judging its viability and long-term investment potential.

Ignoring the impact of AI can expose portfolios to significant risks. Companies failing to adapt or underestimating the importance of AI risk losing competitiveness, seeing their business models become obsolete, and suffering market share erosion. Therefore, a wise portfolio manager must not only seek investment opportunities in companies directly involved in AI development but also assess how AI is influencing and transforming traditional industries.

By integrating analysis of AI adoption and application into their decision-making process, portfolio managers can identify companies well positioned to succeed in today’s economy and poised to innovate and thrive in the future. This implies a deep understanding of technological trends and an ability to anticipate how these trends will affect different sectors and businesses.

Ultimately, AI is not simply an investment sector; it is a prism through which all potential investments must be evaluated to ensure sustainable growth and robust portfolio performance.

II. INDIA, the leading emerging player

” The Indian economy presents a picture of resilience and dynamism ” RBI Governor Shaktikanta

Source : X(formerly Twitter)

India, currently the world’s fifth-largest economy with a GDP of almost US$4 trillion, stands out as one of the most dynamic and promising economies globally. With robust macroeconomic fundamentals and a policy focused on stimulating infrastructure investment, India forecasts sustained growth of 6-7%, outperforming most of its emerging market counterparts.

This growth, less dependent on resources compared to China’s, is primarily driven by the service sector, attracting increasing interest from Western investors and poised for continued outperformance.

Graph : Leading economic indicators

Sources : Bloomberg, Richelieu Group

The ongoing logistics revolution in India, characterized by a substantial enhancement in transport infrastructure, has the potential to elevate the country’s structural growth rate to 8-10%. The expansion of the road network by over 40% in the past decade and the government’s initiatives to reduce logistics costs from 16% of GDP to around 8%, particularly through improvements in rail and road infrastructure, play a pivotal role in this transformation. These advancements, coupled with measures like financial inclusion and digital progress, are driving growth in the manufacturing sector. The government aims to construct 80,000 kilometers of four-lane freeways and 8,000 kilometers of new freight rail lines. As part of its «speed and power» master plan, it plans to allocate $1.4 trillion to integrate various modes of transport.

India’s consistent climb in the World Bank’s Global Logistics Performance Index rankings indicates that the decade-long effort to revamp the country’s transport infrastructure is yielding positive results.

The Indian economy is also benefiting from substantial public investment and a rebound in private consumption. India faces challenges, including dependence on energy imports, the imperative to create sufficient jobs for its growing working-age population, and managing its increasing public debt. India aims to industrialize its economy and enhance competitiveness in its underdeveloped manufacturing sector. To achieve this, infrastructure development has become a political imperative. If the private sector fulfills its commitments, India could sustain annual growth in total capital expenditure of up to 10%. To ensure sustainable growth, additional private sector investment is crucial, supported by Indian companies with robust balance sheets and banks ready to lend.

Despite a negative image on stock markets, the residential real estate sector is a significant prospect for the future, buoyed by lower interest rates and government support for affordable housing. The Indian banking system remains robust, exhibiting high credit growth and solid asset balance sheets.

Source : Reuters

The construction sector is now the second-largest source of employment in India after agriculture, employing around 20% of the workforce. However, about 90% of construction workers are still informally employed, with minimal legal protection and very low wages. India urgently needs to create numerous new jobs to cater to its growing working-age population, with over half of the population under 25.

The positive news is that increased spending on infrastructure will bolster formal employment in construction. Almost half of this year’s infrastructure spending budget of $120 billion, or 3.3% of GDP, is allocated to roads and railroads.

Source : X (formerly Twitter)

India, recently surpassing China in terms of population, is unlikely to replicate China’s resource-intensive growth model. Nevertheless, it remains attractive to investors due to the increasing formalization of its economy and the diversification it offers compared to other emerging markets. Despite challenges such as energy dependence and the need for job creation, the outlook for Indian assets remains optimistic.

The pivotal story in the current scenario is the ascent of India’s capital expenditure cycle. The share of investment in GDP has risen in recent quarters to 34%, approaching the peaks seen in the early 2010s.

An area of concern remains with regard to investment. Household net financial savings are at a record low, limiting the funds available for investment. Another factor is foreign direct investment (FDI). Lower FDI may reflect a brief consequence of tighter global liquidity, particularly as manufacturers are under pressure to diversify their supply chains away from China.

India’s strength in services exports is helping to mitigate the external deficit. Net exports of services have doubled to $150 billion in recent years, helping offset the widening trade deficit in goods.

India’s current account deficit

Sources: Bloomberg, Richelieu Group

Inflation remains a structural weakness. Commodity prices, especially for oil, gas, and cereals, have risen significantly in recent months. The depreciation of the rupee has also contributed to inflation. High inflation could negatively impact India’s economic growth by reducing consumers’ purchasing power, which, in turn, can reduce demand.

Indian inflation and Central Bank rate

Sources: Bloomberg, Richelieu Group

The Central Bank of India has raised its growth forecast for the current fiscal year, in response to a robust economy, and indicated that it would maintain a tight monetary policy while monitoring inflation risks. The Reserve Bank of India expects the economy to grow by 7% in the current financial year.

In conclusion, India, with its transformative trajectory, steady growth, and unique assets, represents a solid strategic investment opportunity. Despite past disappointments due to over-optimism, India, with its consistent growth, ambitious initiatives, and unique characteristics, stands out as an attractive market. India’s growth rates surpass its debt servicing costs, alleviating concerns about debt sustainability. Financing the current account deficit should not be problematic, even if the government continues to spend. The inclusion of Indian bonds in JP Morgan’s benchmark indices will stimulate passive inflows. The depreciation of the rupee could temper foreign investors’ gains in India due to higher prices and import costs. The Central Bank of India (RBI) has accumulated a reserve of $600 billion in foreign exchange reserves, which it can deploy to mitigate external shocks. However, given India’s inflation differentials, energy resource constraints, and mixed prospects for increased manufacturing exports, the rupee is structurally destined to remain on a downward trend.

While India may not replicate China’s growth model, it offers the promise of stable, solid returns, justifying a strategic allocation in a world where certainty is rare. India’s prospects stand out in the emerging zone, despite the volatility associated with any transformation.

Equity index

Sources: Bloomberg, Richelieu Group

III. Hybride Corporate: performance with quality

European hybrid securities issued by non-financial companies have become a puzzle for both credit investors and corporate issuers in the current era of high interest rates and tighter credit conditions. In the past, ultra-low borrowing costs, combined with narrow credit spreads, created an optimal environment for the issuance of these instruments. Hybrids enabled issuers to balance financial leverage and maintain balance sheet flexibility, offering investors a higher return than senior debt.

Hybrid corporate bonds are subordinated debt instruments issued by non-financial companies. Termed “hybrids” due to their combination of bond and equity characteristics, rating agencies consider them as half debt and half equity, applying the concept of “equity content.”

Corporate hybrids are subordinated instruments, placing the investor lower in the issuer’s capital structure. In the event of insolvency, recovery values are likely to be lower than with more senior instruments.

While corporate hybrids are perpetual securities, they can be recalled by the issuer (at its discretion), typically after 5 years from the issue date at the earliest.

From the first call date, the issuer pays a fixed coupon. Failure to call results in the coupon being reset to the swap rate plus the spread at which the hybrid was issued.

The issuer may suspend or defer coupon payments under certain conditions without triggering a default event. However, coupons are cumulative or cumulative and compound.

For the issuer, issuing a hybrid bond has clear advantages. Hybrids are less expensive than an IPO or capital increase, enable coupon payment deductions for tax purposes, and support the issuer’s senior bond rating due to the 50% equity content.

For the investor, the primary advantage lies in the opportunity to invest in a solid investment-grade rated issuer (in fact, almost all hybrid issuers in the EU are IG-rated at the senior level) while potentially obtaining a higher return by moving down the issuer’s capital structure.

The spread between senior and hybrid bonds can vary considerably depending on market conditions. Risks of coupon extensions and deferrals are generally rare for solid IG issuers. Furthermore, according to S&P’s methodology, hybrids lose their equity content after the call date (as long as the issuer remains IG rated), incentivizing the issuer to recall the bond as well as for its reputation in the market.

Hybrid issuance was robust over the 2019-2021 period, reaching almost 100 billion euros, representing 45% of cumulative hybrid issuance from 2010 to 2021.

Percentage of total by year of emission

Source: Credit sight

This has created an optimal environment for non-financial corporate borrowers to issue this type of instrument. Thanks to their treatment by the rating agencies (equity content), issuers have been able to strike an appropriate balance between maintaining leverage targets and a flexible capital structure, while preserving the rating on senior debt.

Composition by rating

Sources: Bloomberg, Richelieu Group

In recent quarters, the market environment has undergone a significant change. Rising borrowing costs and a volatile credit risk sentiment environment led to an increase in the weighted average coupon rate of corporate hybrids issued in 2023, jumping to 6.5% from 4.5% in 2022. Consequently, it has become more expensive for companies to issue this type of debt. In the coming years, many hybrid instruments will approach their first call date, and issuers will need to decide whether to refinance, redeem, or extend these securities. Net issuance is expected to remain moderate due to higher issuance costs. This lower issuance volume will give hybrids a scarcity value, supporting the technical context for performance.

A key positive for the asset class is that almost all non-financial hybrids in the EU are issued by companies whose senior debt is IG-rated, providing a natural incentive for regular hybrid issuers with strong balance sheets to refinance even at a higher price to maintain credibility with investors.

Therefore, we expect the majority of issuers of IG-rated hybrids to recall their hybrids on their first call date and refinance them.

Examining the asset class’s composition and basing the analysis on the Bloomberg Euro Universal Corporate ex Financials Hybrid Capital Securities 8% Capped index, we observe that almost all euro-denominated corporate hybrids in circulation today are issued by companies whose senior debt is currently rated IG. Furthermore, almost 60% of the hybrid bonds eligible for the index are also IG-rated, and even the remaining 40% HY-rated are almost all issued by IG-rated companies.

In terms of sector distribution, utilities clearly dominate the hybrid universe, accounting for almost a third of the index. Other major sectors included are Energy (18%), Telecoms (14%), Automotive (10%), and Real Estate (10%), with the remaining sectors accounting for less than 5%. Except for Real Estate, which remains under acute pressure, the other sectors are considered fundamentally sound and well positioned to meet the refinancing needs of future hybrids.

Breakdown by industry

Sources: Bloomberg, Richelieu Group

From a valuation perspective, using data provided by CreditSights, almost 85% of European corporate hybrids trade with an OAS spread of over 200 basis points (bps), and over 40% trade with a spread of over 300 bps.

Hybrid index spread

Sources: Bloomberg, Richelieu Group

Hybrid valuations remain attractive compared to historical levels, especially when comparing them to senior bonds issued by the same issuers. There is also a wide distribution (dispersion) of valuations in the hybrid space.

Coupons remain attractive.

This illustrates the challenge of distinguishing between beta market risk (sentiment towards the asset class) and credit risk (extension/default concerns).

OAS spreads by rating

Sources: Bloomberg, Richelieu Group

In addition to higher volatility than conventional bonds, this type of investment is only suitable for clients with the right risk profile and risk appetite.

Risks associated with hybrids include:

· Subordination risk: Hybrids are subordinated debt instruments, generally rated 2 to 3 notches below the senior debt of the same issuer by rating agencies.

· Extension risk: An issuer may decide not to recall the hybrid on its first call date.

· Deferred coupon payment: The issuer may decide not to pay one or more coupons.

· Early call risk: Certain specific clauses in the prospectus may stipulate a 101% early call trigger in the event of changes in the market.

IV. After two years of underperformance by small caps…

Annual performance of Stoxx600 small vs large (since 1999)

Since 2019, funds and ETFs in the “Small & Mid Caps” category have experienced a cumulative net outflow of -€25 billion, while Large Caps funds have garnered €160 billion over the same period. Notably, investors have significantly shifted towards Large Caps funds and ETFs since the beginning of 2023, favoring the visibility and liquidity of Mega-Caps (such as Nvidia, Apple, Microsoft, or in France, LVMH, L’Oréal, Total). European small caps have faced diminished favor for several years now.

The Small & Mid Caps segment has exhibited a continuous decline in recent years, a trend that has accelerated since the onset of 2022 with the war in Ukraine.

Year-to-date flows by management style

Source : Goldman Sachs

Large-cap categories, on the whole, have recovered from the decline observed in 2022 and have performed well since the start of 2023. In contrast, the “Small & Mid Caps” category lags behind, presenting a gap of -25% compared to the “Large Caps” categories over the past 2 years.

Small & Large Caps Index

Sources: Bloomberg, Richelieu Group

Small caps currently exhibit no premium to large caps, whereas historically, the valuation premium has been around 20%. Consequently, the P/E ratio of European small caps (over the next 12 months) has seen a considerable decline over the past 5 years (16x over 10 years vs. 12.8x currently), while that of European large caps has remained relatively stable (13.12x over 10 years vs. 12.5x currently).

Medium PE

Sources: Bloomberg, Richelieu Group

Moreover, small caps are one of the few segments of the market that have deviated from the expected trajectory this year.

Contribution to index performance

Finally, small caps have fully absorbed the rise in the cost of capital, with EV/EBITDA (Enterprise Value to EBITDA) multiples of 8x, the levels seen in 2009.

EV/EBITDA history

Sources: Bloomberg, Richelieu Group

However, this attractive valuation may persist for an extended period. What catalysts could reignite investor interest in the Small Caps segment?

Primarily, the majority of European companies listed in this segment are correlated with the growth cycle. To justify an investment in Small Caps, it is crucial to anticipate favorable growth prospects.

Economic expectations for the Eurozone appear bleak when considering the latest PMI indicators for the zone. The performance of Small Caps is already indicating a hard landing. The change in the stance of central banks will, therefore, be a key catalyst for a more positive view of large caps.

These companies’ earnings are highly sensitive to economic activity, with an estimated multiple of 4 times nominal growth. Disappointment over China’s recovery is impacting certain sectors and countries, with Germany being notably sensitive to China’s economic dynamics.

A crucial factor to understand is that these market segments are sensitive to short-term interest rates. Consequently, any tightening of monetary policy and an increase in key interest rates negatively impact the financing capacity of these companies. As the cost of capital for small caps rises much faster than for large caps, their relative earning power diminishes. It now seems that the ECB is determined to ease monetary policy, aligning with the approach of the FED.

Inflation rates are decreasing faster than anticipated, even though, as Christine Lagarde likes to remind us, the game is not yet won.

Source : X (formerly Twitter)

Money supply growth was a reliable leading indicator of the relative performance of the Eurozone’s Small vs. Large companies. The latter contracted as never before in absolute terms, justifying the underperformance of small caps. Given growth and inflation expectations, the money supply should begin to rise again in 2024, slightly favoring liquidity.

Euro zone money supply

Sources : Bloomberg, Richelieu Group

Indeed, the relative performance of small caps is closely linked to liquidity. Central banks have shifted from injecting liquidity and expanding their balance sheets to drying up this liquidity. The rise in real interest rates has also had a significant impact.

Small versus Large versus German real rate

Sources : Bloomberg, Richelieu Group

Small-cap stocks tend to amplify market movements, both up and down. For instance, European small caps rebounded by around +90% one year after the decline triggered by the subprime crisis, and European micro-caps posted a +115% performance in one year after the fall triggered by the COVID-19 crisis.

Certain sectors require a stabilization of the interest rate environment to rebound. The appropriateness of an investment is always assessed by means of a Rate of Return on Investment, compared with the cost of financing the investment. As the cost of financing rises, the breakeven point of the investment also rises. Now that interest rates have stabilized, the market can be expected to recover. This is the primary catalyst expected to boost the value of small caps, which are more sensitive to the cycle.

Despite this challenging context, which is the consensus among investors, now is a good time to reinvest. The Small & Mid Caps market has been underweight for too long. In the past, periods of decline have never been as lengthy as they are now. Despite this stock market underperformance, companies continue to post sustained growth. Earnings per share growth for 2024 is expected to rise by 18% (compared with 6.5% in 2023), well above that of large caps (expected to be less than 4%)!

Mergers and buyouts should pick up again in 2024, assisted by historically low valuations. Towards the end of the year, several deals with high premiums for investors have already been witnessed (takeover bids for Clasquin, SII…).

Clasquin and SII courses

Sources : Bloomberg, Richelieu Group

After a year of robust growth in 2021-2022, the M&A market slowed down, primarily due to higher credit costs combined with high prices. While mid- and small-cap deals remain more intact, their pace has slowed due to economic conditions. Factors such as geopolitical tensions resulting from the war in Ukraine and the rise in interest rates by central banks have contributed to this slowdown. A return to a certain normality should contribute to a greater appetite.

Small caps have faced a myriad of fears since 2022, including high growth whose sustainability was questioned in the current macroeconomic context, a less favorable sectoral and geographic mix due to the war in Ukraine and energy supply concerns, greater cyclicality, sensitivity to political risks, strong outflows, less market dispersion, weak M&A… All these concerns have been valid, as 2023 has delivered another year of underperformance and outflows.

For 2024, most of the headwinds facing Small Caps seem to be behind us. However, the deterioration in financing conditions should lead to strong dispersion. Return on capital employed (ROCE) and balance sheet quality appear to be the best performance indicators in this category. In short, our investment strategy will remain focused on selecting highly profitable, low-debt companies that are undervalued by the market. This approach seems particularly relevant in the current context.

Synthesis Strategy Richelieu Group – Author

Alexandre HEZEZ

Group Strategist

Disclaimer

This document was produced by Richelieu Gestion, a management company and subsidiary of Compagnie Financière Richelieu. This document may be based on public information. Although Richelieu Gestion makes every effort to use reliable and complete information, Richelieu Gestion does not guarantee in any way that the information presented in this document is reliable and complete. The opinions, views and other information contained in this document are subject to change without notice.

This document was produced by Richelieu Gestion, a management company and subsidiary of Compagnie Financière Richelieu. This document may be based on public information. Although Richelieu Gestion makes every effort to use reliable and complete information, Richelieu Gestion does not guarantee in any way that the information presented in this document is reliable and complete. The opinions, views and other information contained in this document are subject to change without notice.

The information, opinions and estimates contained in this document are for information purposes only. No element can be considered as an investment advice or a recommendation, a canvassing, a solicitation, an invitation or an offer to sell or to subscribe to the securities or financial instruments mentioned. The information provided concerning the performance of a security or financial instrument always refers to the past. Past performance of securities or financial instruments is not a reliable indicator of future performance.

All potential investors should conduct their own analysis of the legal, tax, accounting and regulatory aspects of each transaction, if necessary with the advice of their usual advisors, in order to be able to determine the benefits and risks of the transaction and its appropriateness to their particular financial situation. He does not rely on Richelieu Gestion for this.

Finally, the content of the research or analysis documents or their excerpts, if any, attached or quoted, may have been altered, modified or summarized. This document has not been prepared in accordance with the regulatory provisions designed to promote the independence of financial analysis. Richelieu Gestion is not prohibited from trading in the securities or financial instruments mentioned in this document prior to its publication.

Market data is from Bloomberg sources.