Do SVB and CRÉDIT SUISSE signal a halt to the normalization of central bank rates?

By Alexandre Hezez, Group Strategist

Editorial

In all the countries affected by the crisis, the authorities acted urgently to prevent the situation from worsening. In the United States, the Treasury, the Fed and the FDIC moved quickly. The almost immediate action of the Fed (1 day against 1 month in the Lehman case), if it shows that the Fed is taking the situation seriously, aims above all to reassure and avoid the phenomena of contagion and generalized flight of deposits. With the support of the Swiss government and the Swiss national bank, UBS decided to buy Credit Suisse. In a way, this put an end to the latter’s collapse and restored confidence in the Swiss banking system. Such an operation was made possible by a public guarantee of the risk of default, while the question remains whether further rescues will be necessary.

The crash takeover of the Swiss bank last Sunday by its main competitor, UBS, shows that the financial sector remains exposed to the slightest failure of a major institution, but also the authorities’ desire not to plunge back into a systemic crisis.

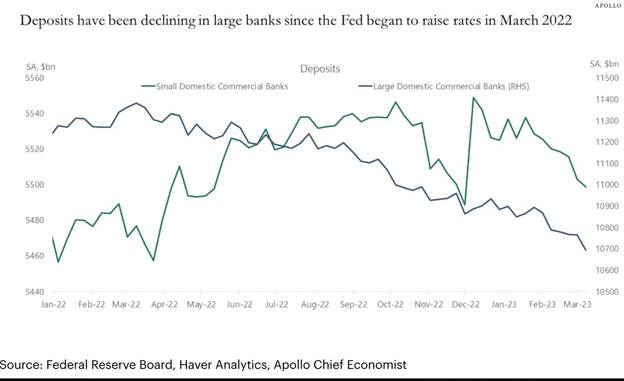

The crisis is not yet over on the other side of the Atlantic, where regional banks are still under attack from crises of confidence among savers and investors. First Republic Bank, one of the most pressured U.S. regional banks, lost a large portion of its deposits following the collapses of Silicon Valley Bank and Signature Bank. It was supported by 11 major U.S. banks that contributed $30 billion in deposits. US PacWest has seen its deposit base melt by 20% since the end of last year. This contraction is largely due to withdrawals from private equity firms, whose deposits have fallen 43%.

Source: Twitter @Schuldensuehner

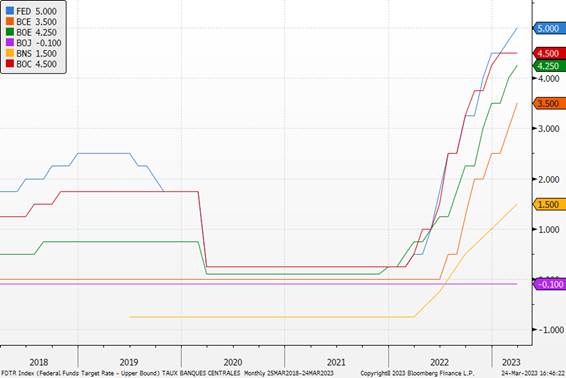

The causes of the crisis are obviously multiple in the United States and in Europe. The language of Jerome Powell at his last meeting contrasts with that of the Swiss National Bank (SNB). Jerome Powell emphasized the uncertainty that prevailed for the future. He believes that the current crisis around the banks will help tighten the financing conditions for the US economy. For its part, the Swiss National Bank’s statement tried to circumscribe the episode: “The measures announced this weekend (…) have put an end to the crisis”.

On the European Union side, the tone remains the same. Like the SNB, the ECB raised rates by an expected 50 bps at its last policy meeting. The situation of European banks differs from that of American banks for a very simple reason: they are not subject to the same rules. For the ECB, the banks of the euro zone are “resilient”. It is true that the rules applied in Europe have been tightened since the financial crisis. Basel III imposes safety cushion rules on banks’ short and long term liquidity, cash and capital. Let’s remember that 400 banking groups are subject to these rules in Europe, and only thirteen in the United States out of 5000 institutions.

Source: LinkedIn

We recall that the liquidity coverage ratio (LCR ) of European banks is 168%, with each bank covering more than 100% of its deposits! The financing also shows a satisfactory duration. Finally, the capital position of European banks is very strong. The risk of a “deposit run“, or banking panic, is very low, which potentially makes European banks immune. The case of the black swan is always possible of course, but it does not seem to us to be a hypothesis for the moment. The strong liquidity position of European banks and their solvency are not in question, thus minimizing an accident such as the one we have experienced in the US. SVB was highly specialized and faced specific problems related to the instability of its deposit base. For more than two years, Credit Suisse had been the weakest link in Europe (share price divided by three before the sectoral jolts in two years) and had been suffering for several months from an unprecedented crisis of confidence. European banks have a completely different structure, both in terms of funding and assets. Nor are there any real “small-cap” or “niche” listed European banks. They all tend to be diversified and have a broad funding base.

Sources : Bloomberg, Richelieu Group

So we have two completely different perceptions of the situation. Should we be concerned? Have central banks gone too far? Is inflation the main issue?

2008 and the spectre of Lehman Brothers are obviously on everyone’s mind, even though the situations of SVB and Lehman are not at all comparable in terms of systemic risk. The regional banks are small in terms of balance sheet and only offer traditional (so-called vanilla) products, whereas Lehman was a major player in structured products and securitization of real estate-based products.

“History doesn’t repeat itself but it often rhymes“. Even if the banking crisis weakens the economic outlook and financial markets, tools and responsiveness are not of the same magnitude, given the experience acquired since 2008. The consequences have been severely felt and everything will be done to avoid a crisis of the same magnitude.

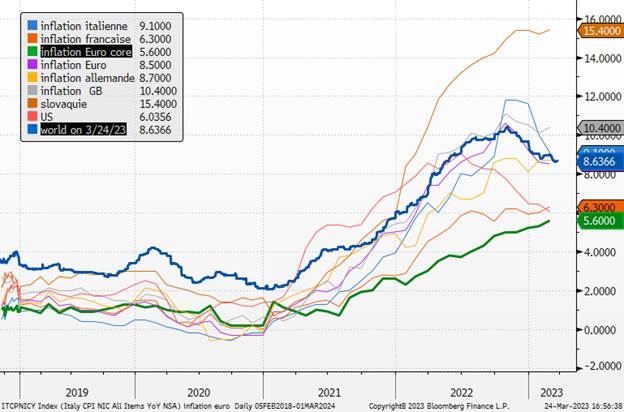

One thing seems certain: the impact on confidence and, above all, on the distribution of credit should deteriorate. The economy should remain resilient, particularly in the Eurozone, thanks to accumulated savings and, of course, to China’s recovery. But we must not forget what central bankers have been fighting for almost two years: inflation.

The dilemma is even more difficult for decision making. Should we fight inflation at all costs and potentially risk destabilizing the financial system? Can we do both at any time?

The answer has so far been given on both sides of the Atlantic. The fight against inflation is a priority in Europe in an economy that is not affected by the banking crisis. In the United States, the reasoning is more measured. The current crisis around the banks will contribute to tightening financing conditions for the US economy (which reduces the need to raise policy rates further) and therefore weigh on growth and thus on inflation.

Sources : Bloomberg, Richelieu Group

Should the ECB’s confidence-building response be reassuring? Is there no weak link in the Eurozone that could send a wave of defiance ?

Some German banks will have to be monitored, but we believe that the authorities will react in the same way as the SNB by forcing mergers.

It is important to note the potential danger of further interest rate increases by the Federal Reserve. While the Fed cannot relax its vigilance on inflation, it is crucial to take into account the current banking crisis and its effects on the credit market. In these uncertain circumstances, further increases could already be risky and a larger increase could worsen the situation and jeopardize financial stability. Even on the European side, it is essential not to take hasty and presumptuous decisions that could compromise a still fragile balance. The contortions necessary to justify an imperative fight against inflation are not comfortable, and the risks involved could be considerable. Under these conditions, it is imperative that the Fed, in the first instance, take prudent action and avoid risky experimentation that could lead to unintended consequences. Priority should be given to financial stability and protection of the economy as a whole, rather than a hasty and rapid attempt at monetary normalization.

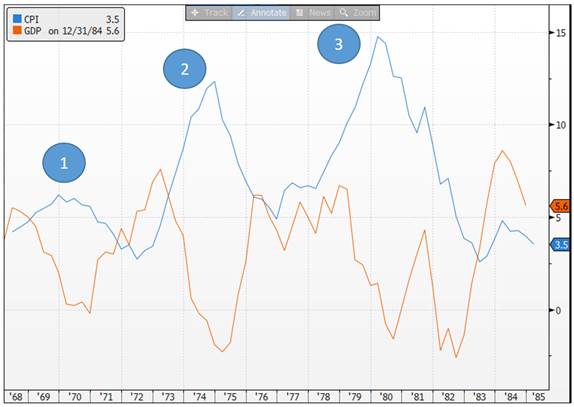

in the 1970s

Sources: Bloomberg, Richelieu Group

We believe that the Fed does not want to put itself in a position where it has to cut rates too quickly and avoid the pitfall of the 1970s with three successive waves of increasingly uncontrollable inflation, partly due to the feverishness of its president at the time when faced with the economic consequences of a restrictive policy. The evolution of the banking crisis will therefore remain central to the Fed and the conduct of its monetary policy. It has already temporarily ended its monetary tightening (Quantitative Tightening)!

Sources : Bloomberg, Richelieu Group

Following Jerome Powell’s latest comments, we expect a final 25 bps rate hike in May and the terminal rate to reach 5.0-5.25%. There has been a lot of talk in recent months about a Fed pivot (often postponed) and it is finally an exogenous event (SVB and Signature Bank bankruptcies) that could cause it. A tightening of bank credit conditions would be the element that could force the Fed to stop, or even backtrack. The new variable that will get attention is the evolution of bank lending figures, which will naturally affect inflation.

Sources: Bloomberg, Richelieu Group

The ECB is not giving up on tightening its monetary policy to fight inflation for the time being because it must remain credible in the strict application of its mandate. Inflation is not yet under control and the SVB effect is still minimal, but the current situation shows and demonstrates that rapid and powerful rate hikes can bring shocks to the most fragile players. Let’s remember that in July 2008, Jean-Claude Trichet raised rates by reminding us that inflation and inflation expectations were the key issue. Consumer prices in the Eurozone jumped by 4% in June 2008, the highest level in 16 years at the time. So let’s not be overly reassured by the confidence of ECB members!

The period we are living through will therefore undoubtedly lead not only to a change in future monetary policy but also to additional pressure on the credibility of central banks to guarantee controlled inflation and stability of the financial system.

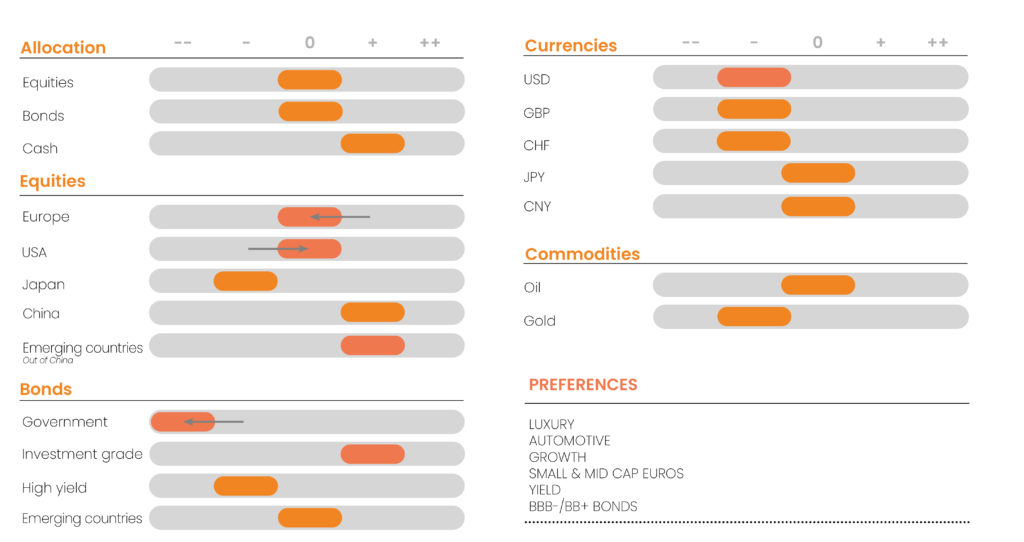

CONVICTIONS

POSITIONING WITH RESPECT TO RISK CRITERIA

“Volatility in sight in the weeks and months to come”

In last month’s publication, we wrote: “Don’t take risks with inflation: short-term caution in the face of inflationary doubts”. In view of what has happened, our caution is justified in hindsight… but for the wrong reasons. Indeed, it was not inflation that sowed doubt, but an exogenous, microeconomic element that triggered a wave of panic: the bankruptcy of SVB.

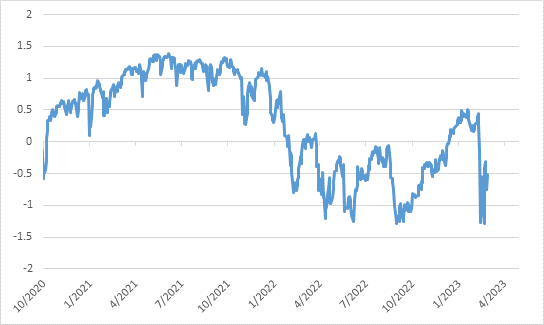

The banking crisis is likely to weigh on the economy, employment and inflation, and puts the central banks of the developed countries in an uncomfortable position. Their balancing act between inflation and economic growth seemed to work. From now on, we must rely on another parameter, the stability of the financial system. The magnitude of these effects is uncertain. Indicators of financial conditions have tightened considerably after the market turmoil, but their level is less critical than during the Covid crisis. This comes at a time when lending conditions are already tight, with borrowing costs for businesses and households having risen sharply, increasing the risk of a perceived economic recession.

Sources : Bloomberg & Richelieu Gestion

In terms of bonds

We are entering uncharted territory and expect central banks to maintain an even more macroeconomic data-dependent approach, with little or no policy guidance. This will continue to keep volatility high in the bond markets depending on the releases. Government rates benefited greatly from the panic and played the role of safe haven from which they had been absent in 2022. The German and US 10-year yields have reached 2.01% and 3.37% respectively, which seems exaggerated, if not to think that we are in a 2008 scenario (see editorial). For sovereign rates in Europe, the bullish effects will be twofold: the European Commission has called on european governments to rebalance their public finances, the upcoming social negotiations are likely to be delicate and could increase mistrust of the sovereign debts of countries experiencing political and social tensions.

Sources : Bloomberg & Richelieu Gestion

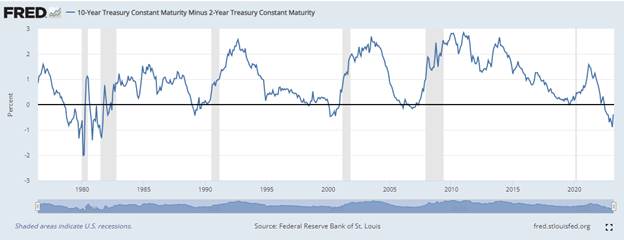

The U.S. economy could see tighter credit conditions due to current macroeconomic fundamentals. The rates market viewed this month’s FOMC action as an accommodative hike. This accommodative interpretation was reflected in a drop in 2-year and 10-year rates after the FOMC communications, which led to a steepening of the US yield curve. The change in Fed rhetoric and the possibility that credit tightening will replace rate hikes also means that the U.S. yield curve will now tend to steepen rather than flatten (or invert!).

Sources: FED saint Louis, Richelieu Group

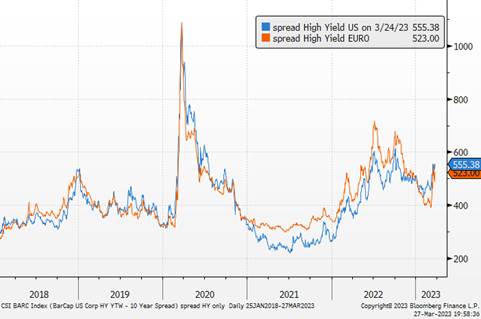

Even if we believe that the banking crisis is likely to put an end to monetary normalization in the near future, central banks will maintain the level of rates reached until 2024 in order to curb the inflation still present. Overall, we remain neutral on the bond segment. It is true that the rates of return remain attractive, but one should be very selective in his approach. The deterioration in access to credit is expected to increase as the environment does not encourage banks as a whole to improve their condition. The higher rate environment encourages us to maintain our exposure to highly rated corporate debt without seeking excessively high yields. The riskiest segments should suffer in these conditions. We remain positioned in the BBB-/BB segment, which we believe is the most resilient. Liquidity remains well rewarded and allows us to be patient. The number of bankruptcies continues to rise significantly in the United States.

Sources : Bloomberg & Richelieu Gestion

This phenomenon is largely linked to the deterioration of credit conditions for the most weakened companies in terms of their balance sheet, and is expected to increase with the banking woes. The Credit Suisse case highlighted the AT1 bank subordinated bond segments in Europe, ruining the holders of these bonds at the time of the UBS takeover. This is probably a major issue. The new lesson we have learned is that shareholders can get money while AT1 holders are wiped out. The Swiss treatment of AT1s is unprecedented and will raise serious doubts about the asset class, increasing spreads. We are very surprised by the lack of prioritization in debt seniority, and we believe this could reshuffle the deck on the valuation of this asset class. From now on, we will stay away and prefer to focus on debt whose seniority presents an opportunity given the rise in risk premiums in the sector.

Sources: Bloomberg, Richelieu Group

In terms of equities

However, we continue to expect global corporate earnings to be flat this year compared to 2022, with risks pointing to a decline in benefits. However, we should see a potential upside in equity earnings multiples due to a weakening outlook for key central bank rates. The easing of central bank liquidity should reduce banking stress but will have limited impact on equities as the other key drivers of equities, namely growth, earnings and real bond yields, are under pressure.

Paradoxically in Europe, the European markets are currently valuing a soft landing but the banks are valuing a much harsher scenario which we do not believe in at this stage. Accumulated savings remain at high levels and should offset consumer stress. The ECB is now in a more uncomfortable position than the FED on its monetary policy as the inflation outlook is far from reassuring and it will still have to show pugnacity despite the turbulence. In addition, the social climate in Europe is tense. In several major European countries, large-scale demonstrations have been spreading in recent weeks. In the UK, 2022 was the year with the most days not worked due to strike action since 1989. This movement seems to continue in 2023, where the beginning of the year is also marked by important demonstrations. Germany also seems to be following this path, where the end of the month marks the beginning of a massive strike called by the transport union. Finally, social tensions continue in France after the adoption of the pension reform. These social movements are occurring in the wake of persistent inflation and could sustain it through second-round wage effects, which would force the ECB to react more strongly than expected. We are downgrading this geographic area to neutral. As for the banking sector, we were significantly overweight at the beginning of the month. The SVB and Credit Suisse episodes have prompted us to be a little more cautious in the short term. Indeed, even if the sector remains very resilient in the Eurozone, attacks on the most fragile elements undermining confidence and causing mistrust cannot be ruled out. The answers to this fear will come quickly and we prefer to be patient. We are neutral on the sector given the growth prospects and dividend payout (and share buybacks) which are not currently in question.

Tighter credit conditions, widening credit spreads, weaker economic growth prospects and a potential spike in bond yields all argue for exposure to defensive growth. Just as we have been writing about credit for several months, we remain absent from companies with fragile balance sheets due to their debt.

Sources: Bloomberg, Richelieu Group

As for the United States, at the heart of the banking storm, it remains weakened. However, recent events have demonstrated the ability of pragmatism of the Fed. Recent events are likely to accelerate the disinflation on housing as a whole and give greater latitude. Unprecedented policy always risks unintended consequences. The process of economic normalization after a global economic standstill was not going to be easy or smooth, and the recent pressures are a collateral effect of the very rapid central bank tightening over the past year. In fact, it’s been just over a year since the Fed started raising rates, and we know that Fed tightening has a lagged effect on the economy. Last year’s record tightening, which really accelerated in mid-2022, highlights the weaknesses in the economy. The Fed’s goal of lowering inflation (by reducing demand/growth through higher interest rates) is now being addressed by investors. However, one positive for stocks remains that the market is taking on the tightening for the Fed right now, moving up the timeline for the end of the Fed’s tightening cycle. And a market that has been very sensitive to Fed policy may find support in a looser policy going forward. It should be the first of the major central banks to reach the “famous pivot point”.

Sources: Bloomberg, Richelieu Group

It is important to note that 5- and 10-year inflation forecasts have recently fallen to between 2 and 2.5%, which encourages a shift to higher earnings multiples (PERs). We are rebalancing our view between Europe and the United States. Despite the very good recent performance of technology stocks, we believe it is important to focus your portfolio on large defensive growth and innovation companies. The latter have the advantage of healthy balance sheets. The fragility of the market comes mainly from retail investors with $1.7 trillion in inflows between early 2020 and mid-2022 (they hold 38% of the U.S. market), which remains a doubt on flows.

Sources: Bloomberg, Richelieu Group

Emerging markets

Investors will find the best value, the most dynamic economic growth prospects and the most favorable conditions for accessing liquidity in emerging markets. In addition, inflation is falling due to the rapid and early monetary tightening by emerging market central banks. The buying power of Chinese consumers is also remarkable. Considering that they will need two years to spend the savings amassed during the pandemic, this would represent an annual increase in consumption of 6%, according to experts. This would lead to an increase in demand for imported products and a boom in Chinese tourism, both of which would benefit Asian economies in particular, who could be among the main winners.

Sources: Bloomberg, Richelieu Group

Our position is favorable to emerging market equities and China in particular. Chinese equities appear particularly attractive due to their recent correction, although a discount to global equities is justified given China’s geopolitical and regulatory risks. Performance will be driven by corporate earnings. As a major exporter of raw materials, Latin America is proving to be an alternative for importing countries as war ravages Ukraine and cripples Russian operations. Economic recovery in China, a key importer and trading partner of the region, will greatly benefit economic activities in Latin America. At the same time, the political tensions between China and the United States provide an opportunity for other nations to re-enter the international arena. In addition to the ongoing consequences of the pandemic, these tensions have led to a restructuring of supply chains, favoring this area. In addition, the majority of central banks in these countries have proven their ability to control inflation effectively. While monetary tightening continues (for now!) in the developed world, some countries are showing signs of slowing down and are expected to be among the first to begin a cycle of interest rate cuts from currently very high levels. After a strong appreciation in 2022, the US dollar is now on a more stable or even downward trajectory, as the bulk of the Fed’s rate hike cycle is complete. This trend benefits emerging countries, as well as the economic growth differential.

Change

In the foreign exchange market, the FOMC statement and the press conference at the end of the month were generally negative for the USD. The depreciation was widespread, with most G10 and emerging market currencies showing a net increase. The change in focus of the release from “continued increases…will be appropriate” to “some additional strengthening of policy may be appropriate” seemed to be the main initial catalyst. Overall, we continue to believe that currencies will be rewarded if central banks maintain their determination to fight inflation. As far as the euro is concerned, the Fed chairman was not as vindictive as Christine Lagarde had been a week ago about his determination to do everything to save the banking sector if necessary, but especially about his confidence in the resilience of the banking sector. The ECB will be less timid in its fight against inflation and should continue to raise interest rates. We therefore remain positioned in favor of the euro against the US currency.

Synthesis Strategy Richelieu Group – Author

Disclaimer

This document was produced by Richelieu Gestion, a management company and subsidiary of Compagnie Financière Richelieu. This document may be based on public information. Although Richelieu Gestion makes every effort to use reliable and complete information, Richelieu Gestion does not guarantee in any way that the information presented in this document is reliable and complete. The opinions, views and other information contained in this document are subject to change without notice.

This document was produced by Richelieu Gestion, a management company and subsidiary of Compagnie Financière Richelieu. This document may be based on public information. Although Richelieu Gestion makes every effort to use reliable and complete information, Richelieu Gestion does not guarantee in any way that the information presented in this document is reliable and complete. The opinions, views and other information contained in this document are subject to change without notice.

The information, opinions and estimates contained in this document are for information purposes only. No element can be considered as an investment advice or a recommendation, a canvassing, a solicitation, an invitation or an offer to sell or to subscribe to the securities or financial instruments mentioned. The information provided concerning the performance of a security or financial instrument always refers to the past. Past performance of securities or financial instruments is not a reliable indicator of future performance.

All potential investors should conduct their own analysis of the legal, tax, accounting and regulatory aspects of each transaction, if necessary with the advice of their usual advisors, in order to be able to determine the benefits and risks of the transaction and its appropriateness to their particular financial situation. He does not rely on Richelieu Gestion for this.

Finally, the content of the research or analysis documents or their excerpts, if any, attached or quoted, may have been altered, modified or summarized. This document has not been prepared in accordance with the regulatory provisions designed to promote the independence of financial analysis. Richelieu Gestion is not prohibited from trading in the securities or financial instruments mentioned in this document prior to its publication.

Market data is from Bloomberg sources.